ad valorem property tax florida

1 Ad valorem tax means a tax based upon the assessed value of property. The Property Appraiser establishes the taxable value of real estate property.

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

10 Mill means one onethousandth of a - United States dollar.

. All definitions set out in chapters 1 and 200 that are applicable to this chapter are included herein. Ad valorem taxes Ad Valorem is a Latin phrase meaning According to the worth. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

The greater the value the higher the assessment. These tax statements are mailed out on or before November 1st of each year with the following discounts in effect for early payment. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Lets say you own a home and you need or want a septic system connection to a sewer system clean energy technology efficiency. Non-ad valorem assessments are also made on real property for essential services such as fire protection and garbage collection.

1 The Board of County Commissioners or. The tax year runs from January 1st to December 31st. Non-ad valorem assessments are fees for specific services such as solid waste disposal water management sewer storm water and special improvements.

Ad valorem or property taxes are collected annually by the county tax collector. Millage may apply to a single levy of taxes or to the cumulative of all levies. Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes.

The actual amount of the taxes is 477965. Florida property taxes are relatively unique because. In our Legislature this year there is a bill advancing that contains an innovative or horrible depending on your point of view idea for financing certain home improvements.

HOMES AND HOMES FOR SPECIAL SERVICES. Ad Valorem Property Tax If you own property in Florida that property is assessed annually by the county property appraiser. It includes land building fixtures and improvements to the land.

Body authorized by law to impose ad valorem taxes. 11 Personal property for the purposes of ad valorem taxation shall be divided into four categories as follows. Total ad valorem taxes 340737 347690 333966 total non-ad valorem assessments 174887 186393 total of ad valorem taxes and non-ad valorem assessments 515624 534083 see reverse side for details parcel number 493935-02-0020 jimenezmercedes e lancaraeduardo 1701 salerno cir weston fl 33327-1900.

It also applies to structural additions to mobiles homes. The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board City Commissioners and other levying bodies set the millage rates. The taxes are assessed on a calendar year from Jan through Dec 365 days.

INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. This application is for use by nonprofit organizations to apply for an ad valorem tax exemption for property.

The Property Tax Oversight PTO program publishes the Florida Ad Valorem Valuation and Tax Data Book twice. Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now. Real estate property taxes.

The tax roll describes each non-ad valorem assessment included on the property tax notice bill. Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing authorities. Ad valorem taxes are levied annually based on the value of real estate property and tangible personal property.

AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR CHARITABLE RELIGIOUS SCIENTIFIC LITERARY ORGANIZATIONS HOSPITALS NURSING. Ad valorem means based on value. Florida Ad Valorem Valuation and Tax Data Book.

Page 1 of 2. Ad Valorem Taxes Real property is located in described geographic areas designated as parcels. In Collier County Florida Ad Valorem or real taxes on real things according to their worth includes taxes on REAL ESTATE and taxes on a businesss Tangible Personal Property.

Lets look at the 2015 Ad Valorem taxes in detail. There are two types of ad valorem or property taxes collected by the Lee County Tax Collectors office. Learn more about Tangible Property Taxes Delinquent Taxes Taxes and assessments are due November 1 and are delinquent April 1.

Non-Ad Valorem Property Tax Financing. Tangible Personal Property Taxes are an ad valorem tax assessed against furniture fixtures and equipment located in businesses and rental property. 4 if paid in November.

Copies of the non-ad valorem tax roll and summary report are due December 15. Taxes usually increase along with the assessments subject to certain exemptions. Tangible personal property taxes refers to ad valorem taxes on the assessed value of furniture fixtures and equipment located in.

They are levied annually. HOMES FOR THE AGED. The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value millages and taxes levied.

3 Oversee property tax administration. Section 1961995 Florida Statutes requires that a referendum be held if. Ad valorem taxes or real property taxes are based on the value of such property and are paid in arrears.

According to Florida Statute 197122 all property owners have the responsibility to know the amount of tax. Tangible personal property taxes. 2 if paid in January.

Ad valorem taxes are based on the value of property. Sections 196195 196196 and 196197 Florida Statutes. Based on those numbers getting the per diem ie the per day amount for our calculations is easy divide 477965 by 365 130949day.

There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property. Florida property taxes are relatively unique because. Taxes must be paid in full and at one time unless the property owner has filed for the installment program or partial payment plan.

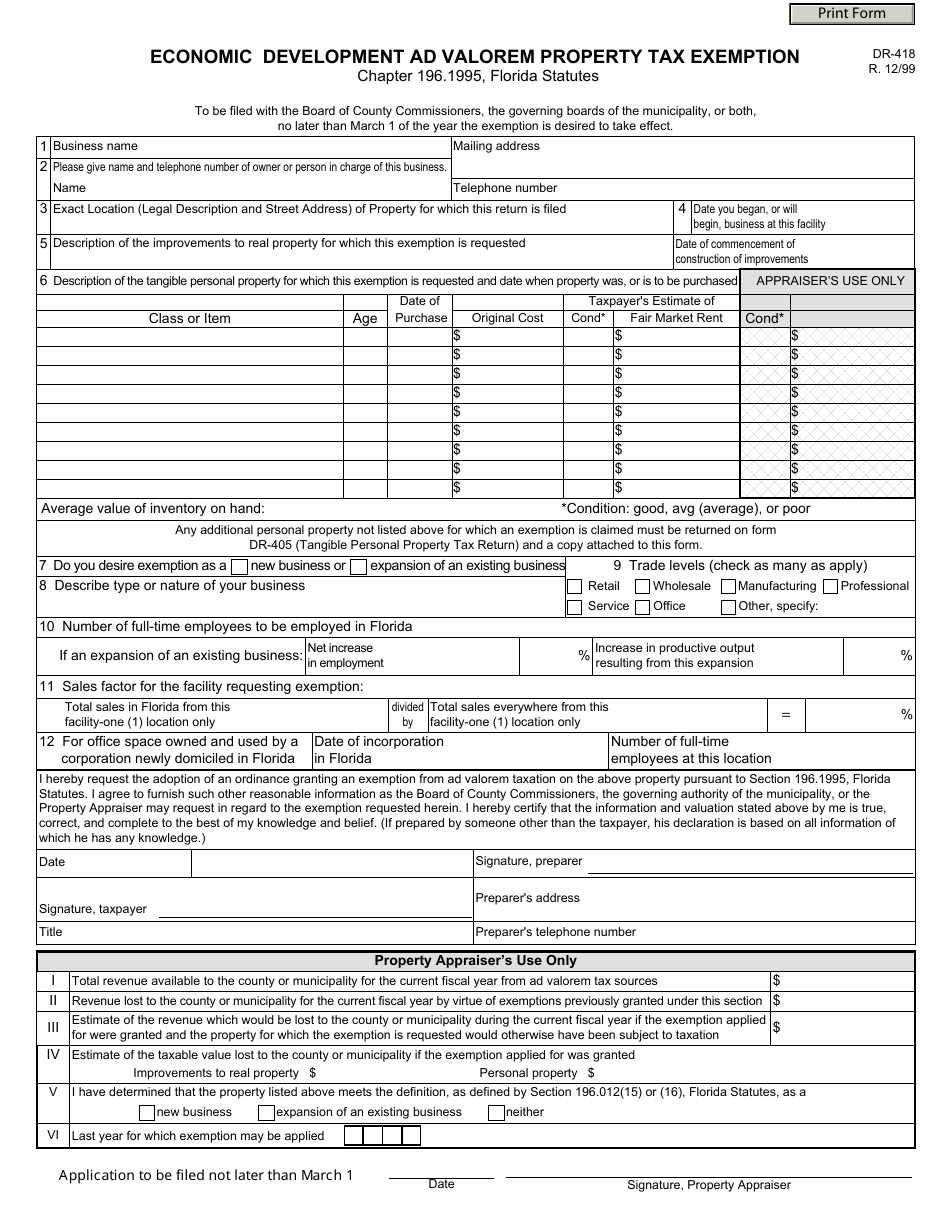

Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant exemptions. The 2021 Florida Statutes. Taxes are normally payable beginning November 1 of that year.

This assessment determines the amount of ad valorem taxes owed each year on your property. 3 if paid in December. In addition the following definitions shall apply in the imposition of ad valorem taxes.

Santa Rosa County property taxes provide the fund local governments to provide needed services such as education law. Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments.

Time Is Running Out To Pay Your Property Taxes No Worries Stop By Avb Bank S Downtown Broken Arrow Location 322 S Main St Thi County Property Tax Bank

Real Estate Taxes City Of Palm Coast Florida

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

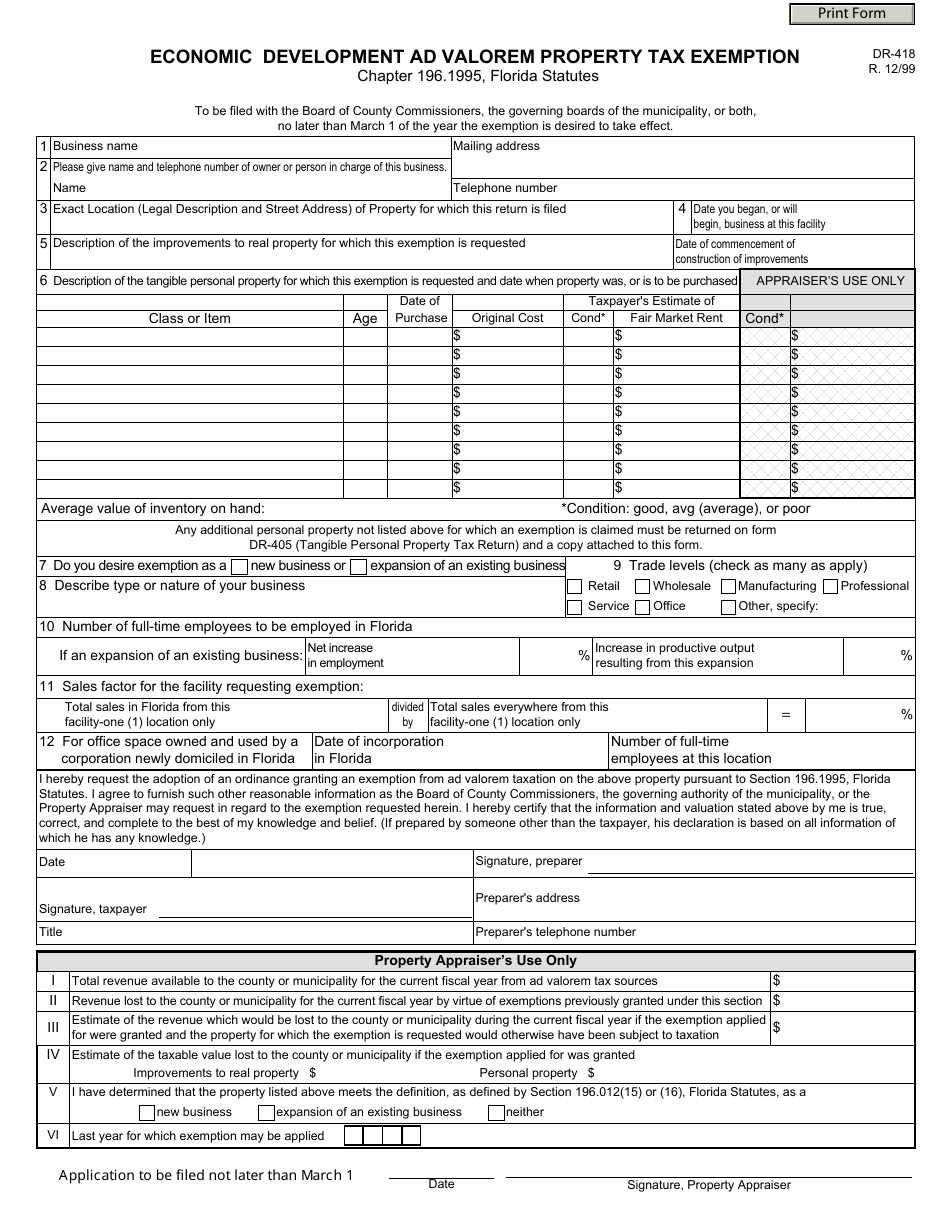

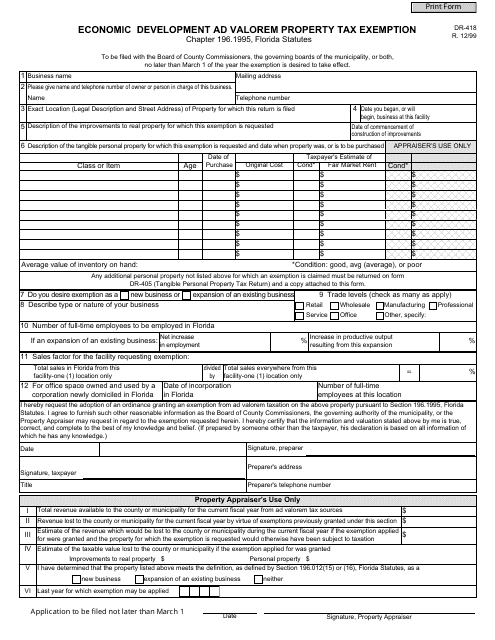

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

Homestead Exemption Template Real Estate Agent Etsy Real Estate Agent Home Buying Checklist Real Estate Checklist

Do Not Miss Your Opportunity To Save It Is Due By March 1st The Florida Homestead Exemption Reduces The Taxable Florida Law Miami Real Estate Real Estate Tips

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Real Estate Property Tax Constitutional Tax Collector

Ad Valorem Vs Non Ad Valorem Taxes

Broward County Property Taxes What You May Not Know

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Understanding Your Tax Bill Seminole County Tax Collector

Pin On Online Business For You

A Guide To Your Property Tax Bill Alachua County Tax Collector

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller